Creating a Travel Budget

Create a comprehensive travel budget for your digital nomad adventures. This guide provides a step-by-step process for planning your finances, tracking expenses, and staying on budget. Achieve your financial goals while exploring the world.

Why You Absolutely Need a Travel Budget Digital Nomad Finances

Seriously, why wing it? Imagine yourself sipping a coconut in Bali, thinking you're rolling in dough, only to realize you're about to run out of funds before your visa even expires. Not fun, right? A travel budget isn't about being stingy; it's about smart spending and making your adventure last. It's about freedom – knowing you can afford that scuba diving trip or that extra week exploring ancient temples. Without a budget, you're essentially driving blind. You might get lucky, but you're far more likely to crash and burn financially. This guide will walk you through building a budget that works for *you*, not against you. We're talking real-world strategies, not some theoretical mumbo jumbo.

Step 1: Calculate Your Income Travel Budget Planning

Okay, let's get real about your income. How much are you *actually* making each month? Don't just look at your best month ever; consider your average income over the past six months or year. Factor in any potential dips or fluctuations. Freelancers, this is especially important for you! Be honest with yourself. Are you getting paid in USD, EUR, or some other currency? This matters because exchange rates can seriously impact your budget. Also, consider the timing of your payments. Do you get paid upfront, or is it net-30? This will affect your cash flow.

If your income is variable, create a 'worst-case scenario' income figure. This is the absolute minimum you expect to earn in a given month. Base your budget on this number to ensure you can cover your expenses even during slow periods. It’s always better to overestimate expenses and underestimate income to give yourself a comfortable buffer.

Step 2: Estimate Fixed Expenses Digital Nomad Costs

Fixed expenses are those that remain relatively constant each month. These are your non-negotiables. Think of things like:

- Rent/Accommodation: Whether you're in an Airbnb, a hostel, or a longer-term apartment, this is likely your biggest expense. Research average accommodation costs in your chosen destination(s).

- Insurance: Travel insurance is non-negotiable. Don't even think about skipping this! We'll talk about options later.

- Software Subscriptions: Adobe Creative Suite, project management tools, VPN – list them all.

- Debt Payments: Student loans, credit card debt – factor these in.

- Phone Bill: Even if you're using a local SIM card, you might still have a US phone bill.

- Savings/Investments: Don't forget to pay yourself! Even a small amount of regular saving adds up.

Be realistic with these numbers. Research average costs in your target locations. Don't assume you can live on $500 a month in Singapore. It's better to overestimate than underestimate.

Step 3: Predict Variable Expenses Budgeting Travel

Variable expenses are those that fluctuate from month to month. These are harder to predict but equally important to budget for. Examples include:

- Food: Eating out vs. cooking at home can drastically impact your food budget.

- Transportation: Flights, trains, buses, taxis, ride-sharing services – track these expenses.

- Activities & Entertainment: Tours, museums, nightlife – budget for fun!

- Co-working Space Fees: If you're not working from your accommodation, factor in co-working costs.

- Visas & Travel Documents: Visa extensions, application fees, etc.

- Shopping: Souvenirs, clothes, toiletries – budget for the essentials and those impulse buys.

- Unexpected Expenses: Always, always, *always* have a buffer for unexpected costs (medical emergencies, lost luggage, etc.).

To estimate variable expenses, track your spending for a week or two. Use a budgeting app (more on those later) or a simple spreadsheet. This will give you a better idea of your spending habits. Also, research average costs for activities and transportation in your chosen destinations. Lonely Planet and Nomad List are great resources.

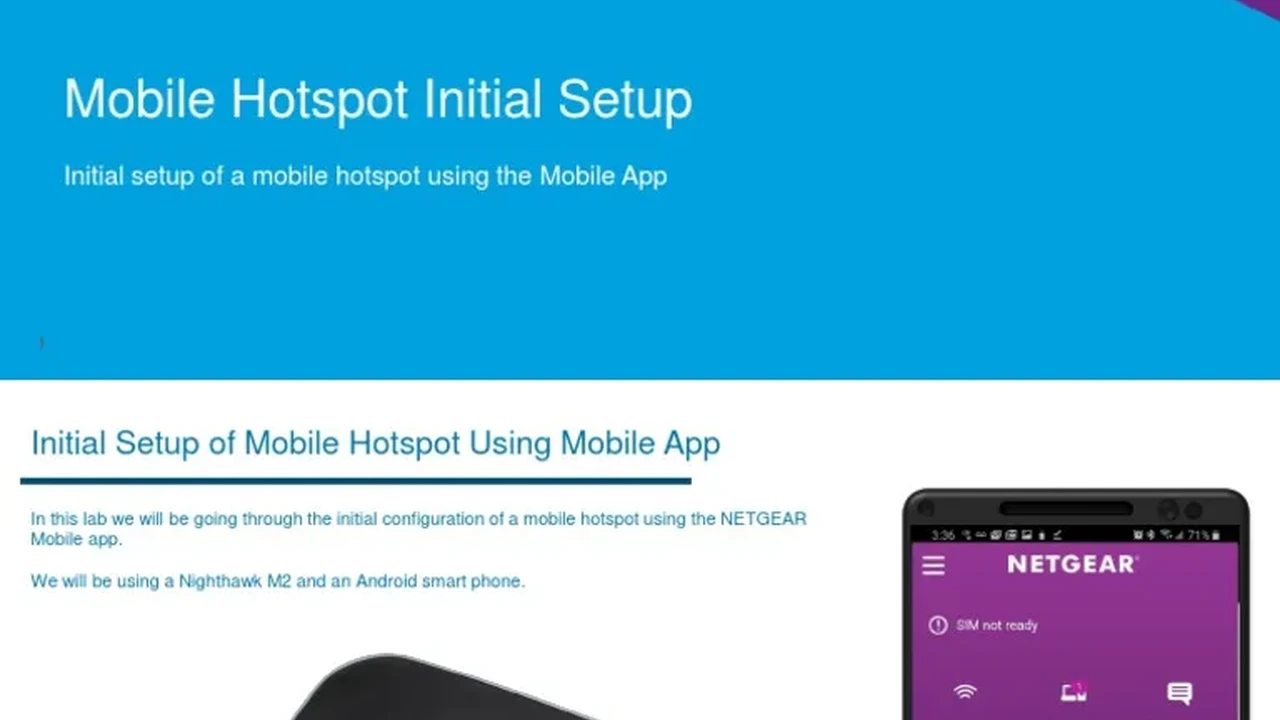

Step 4: Choose Your Budgeting Method Digital Nomad Tools

There are several budgeting methods you can use. Choose the one that best suits your personality and spending style:

- The 50/30/20 Rule: 50% of your income goes to needs, 30% to wants, and 20% to savings/debt repayment.

- The Zero-Based Budget: Every dollar has a purpose. Your income minus your expenses equals zero.

- The Envelope System: Allocate cash to different categories (food, entertainment, etc.) and only spend what's in the envelope. This is great for controlling impulse spending.

- Budgeting Apps: Mint, YNAB (You Need A Budget), Personal Capital, and TravelSpend are popular options.

- Spreadsheets: A simple spreadsheet can be just as effective. Google Sheets is free and accessible from anywhere.

Experiment with different methods to find what works best for you. The key is consistency. Track your spending regularly and adjust your budget as needed.

Step 5: Track Your Spending Budget Management

This is where the rubber meets the road. Tracking your spending is crucial for staying on budget. Use your chosen budgeting method (app, spreadsheet, etc.) to record every expense. Be honest with yourself! Don't fudge the numbers. If you overspend in one category, adjust your budget accordingly. Maybe you need to cut back on eating out or find cheaper accommodation.

Regularly review your spending. Are you sticking to your budget? Are there any areas where you're consistently overspending? Are there any unexpected expenses you need to account for? The more you track, the better you'll understand your spending habits and the more effectively you can manage your finances.

Step 6: Adjust and Optimize Your Budget Digital Nomad Finance

Your budget is not set in stone. It's a living document that should be adjusted as needed. As you travel and experience new things, your expenses will change. Maybe you find a cheaper long-term apartment, or maybe you decide to splurge on a once-in-a-lifetime experience. That's okay! Just adjust your budget accordingly.

Look for ways to optimize your budget. Can you cook more meals at home? Can you find cheaper transportation options? Can you negotiate a better rate on your accommodation? Small changes can add up to significant savings over time.

Recommended Products and Services for Budgeting Digital Nomad Lifestyle

Here are some specific products and services that can help you create and manage your travel budget:

YNAB (You Need A Budget) Budgeting App Review

Description: YNAB is a powerful budgeting app that uses the zero-based budgeting method. It forces you to allocate every dollar to a specific purpose, helping you gain control of your finances.

Use Case: Ideal for digital nomads who want a detailed and comprehensive budgeting system. Especially useful if you struggle with overspending or have complex financial needs.

Comparison: YNAB is more expensive than some other budgeting apps, but it offers a lot of features and a proven methodology. It's a good choice for those who are serious about getting their finances in order.

Price: Approximately $14.99/month or $99/year.

TravelSpend Budget App for Travel

Description: TravelSpend is specifically designed for tracking expenses while traveling. It allows you to record expenses in different currencies, categorize your spending, and generate reports.

Use Case: Perfect for digital nomads who want a simple and easy-to-use app for tracking their travel expenses. Especially helpful if you're traveling to multiple countries with different currencies.

Comparison: TravelSpend is less feature-rich than YNAB, but it's more focused on travel-specific expenses. It's a good choice for those who want a simple and straightforward way to track their spending on the road.

Price: Free version available; premium version with more features starts at around $2.99/month.

Wise (formerly TransferWise) Money Transfer Review

Description: Wise is a money transfer service that allows you to send and receive money internationally at low fees and with transparent exchange rates.

Use Case: Essential for digital nomads who need to transfer money between different bank accounts or currencies. Especially useful for receiving payments from international clients or paying for expenses in foreign countries.

Comparison: Wise offers better exchange rates and lower fees than traditional banks. It's a much more cost-effective way to transfer money internationally.

Price: Fees vary depending on the currency and amount being transferred, but they are generally lower than traditional banks.

World Nomads Travel Insurance Digital Nomad Security

Description: World Nomads is a travel insurance provider that offers comprehensive coverage for digital nomads and long-term travelers. They cover medical emergencies, trip cancellations, lost luggage, and more.

Use Case: Absolutely essential for protecting yourself against unexpected events while traveling. Provides peace of mind knowing that you're covered in case of a medical emergency or other unforeseen circumstance.

Comparison: World Nomads is more expensive than some other travel insurance providers, but they offer a higher level of coverage and are specifically designed for digital nomads.

Price: Varies depending on your age, destination, and length of trip. Get a quote on their website.

Final Thoughts Creating Financial Freedom

Creating a travel budget might seem daunting, but it's an essential step towards achieving financial freedom and enjoying your digital nomad lifestyle to the fullest. By following these steps and using the right tools, you can take control of your finances and make your travel dreams a reality. Remember to be realistic, track your spending, and adjust your budget as needed. Happy travels!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)